So yesterday when I posted my data from my blog post on r/Eve on the High Slots of the Vulture Doctrine Fit, I got a great response and it was full great comments and conversations that forced me to really reevaluate my approach to my data and my recommendations for you all.

So I wanted to highlight and address some of the comments directly here on the blog in order to keep the conversation going.

The Numbers

- 14k Views in <48 hours

- 39 (including my responses) High Quality Comments within 24 hours of posting

- 87% upvote ratio

The Comment That Changed Everything

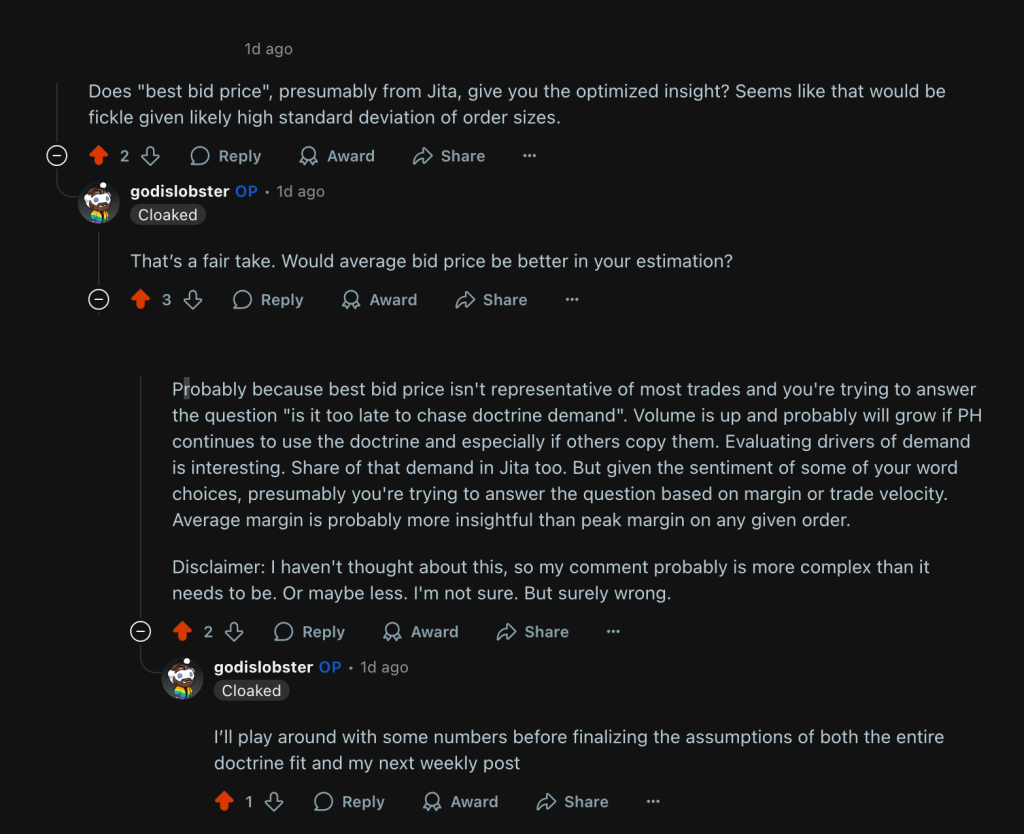

This comment here forced a full reevaluation of my data setup. Up until now, I’ve been using a lightweight set up, using the Adam4Eve API, to get quick and reactive signals. The goal in using this data for my blogs and Reddit posts was and is to deliver timely, actionable insights based on accessible data, but quickly put together. While this data can provide short-term market move signals, they aren’t the best signals I can produce for sharper, more powerful recommendations.

To that end, I will move away from APIs and move towards building a local, queryable database using the half hour market snapshots from EVE Ref. That said, if I need quick insights, the API is pretty much always there. The plan was always to move towards a more powerful set up, but this comment forced my hand.

This will allow me to go beyond basic volume and price snapshots, but deeper analysis like volume-weighted average prices (VWAP), margin bands, and trade velocity.

Many thanks to the valuable feedback from u/, I am excited to evolve my approach and deliver stronger insights and analysis for traders and industrialists.

The Comment That Made Me Blush and Want an MBA

Yes.

I am trying to effectively live out a dream of being a financial analyst and this just tickled me.

Long story short, I am more of a “save the world” type then a “plunder the world of its riches” type, but I have strong business acumen and a strong inclination towards workaholism. I would excel in the finance sector, but I’d burn out so fast.

Burnout is not an option any longer for my life, and while I would love being a finance bro in NYC, I am also not in love with the long hours and general toxic work cultures of Wall Street and Midtown.

So I play one in EVE, because that is my lane and I get to work on my skills for something I do also feel called to and make the world a better place. Plus I am just a data nerd and any data is actually kinda fun once you get the hang of it.

To bring it back around — while this post turned into a bit of a reflection on method and motivation, my core goal remains the same: to provide timely, actionable, and increasingly powerful market insights for EVE traders and industrialists.

The community feedback, especially on Reddit, has pushed me to raise the bar — moving beyond quick API snapshots and toward deeper, more rigorous analysis using EVE Ref market history. Expect upcoming reports to include metrics like VWAP, margin bands, and trade velocity, designed to support real in-game decisions, not just theorycrafting.

If you’re into the econ side of EVE, or just want better tools for your trade strategy, subscribe to the blog or jump into the conversation on Reddit — your feedback is shaping this in real time.

Let’s keep raking in that sweet ISK. o7