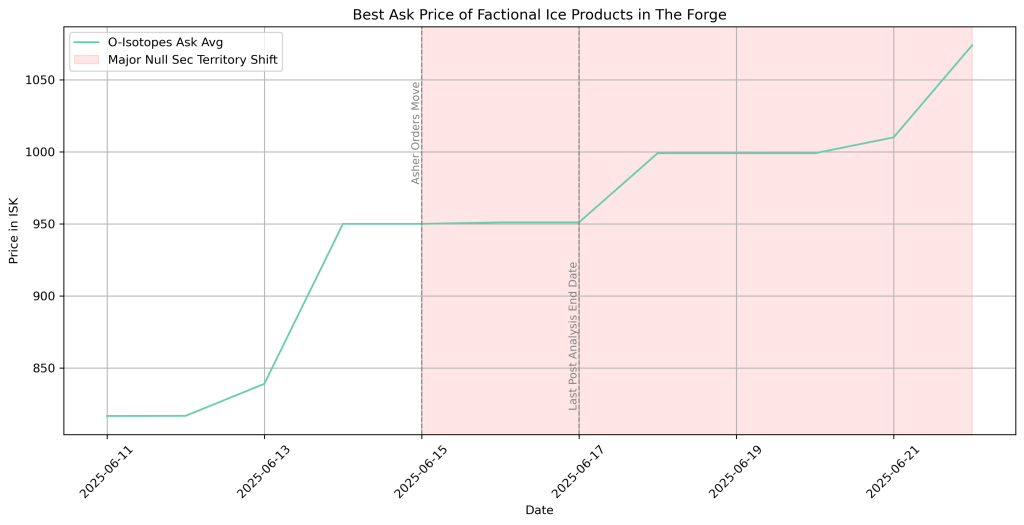

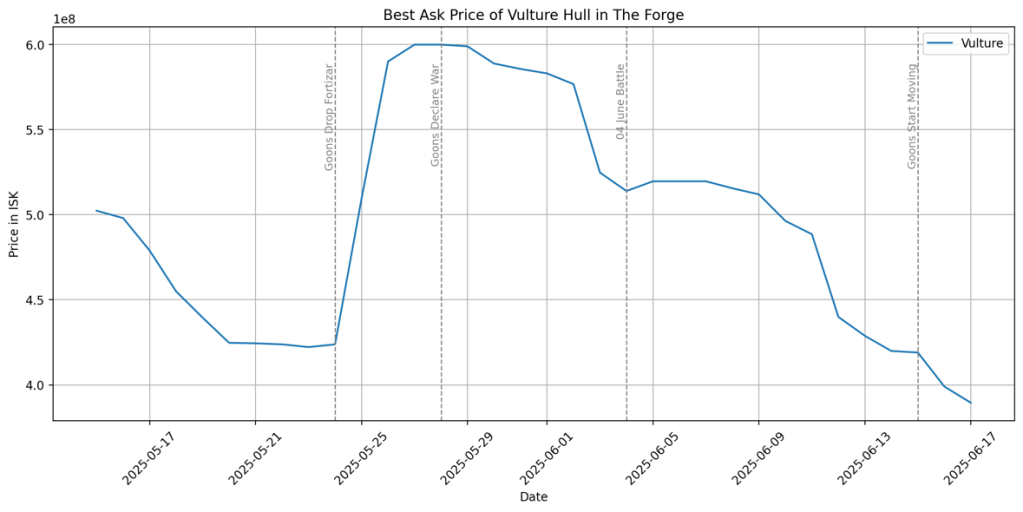

I was discussing the latest meta with a contact on Discord and quickly made some demand curve discoveries that might be signaling things to come in the future of Null Sec politics and territory expansion.

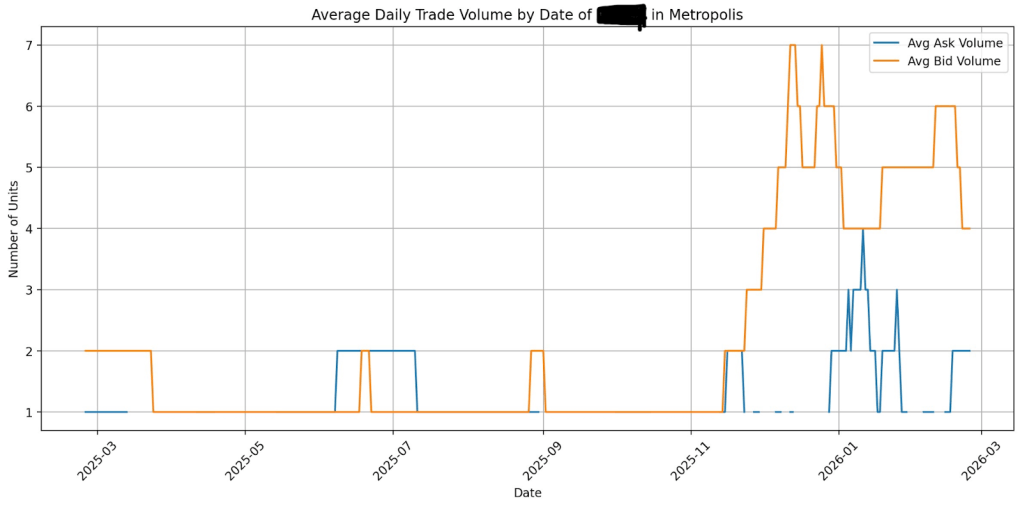

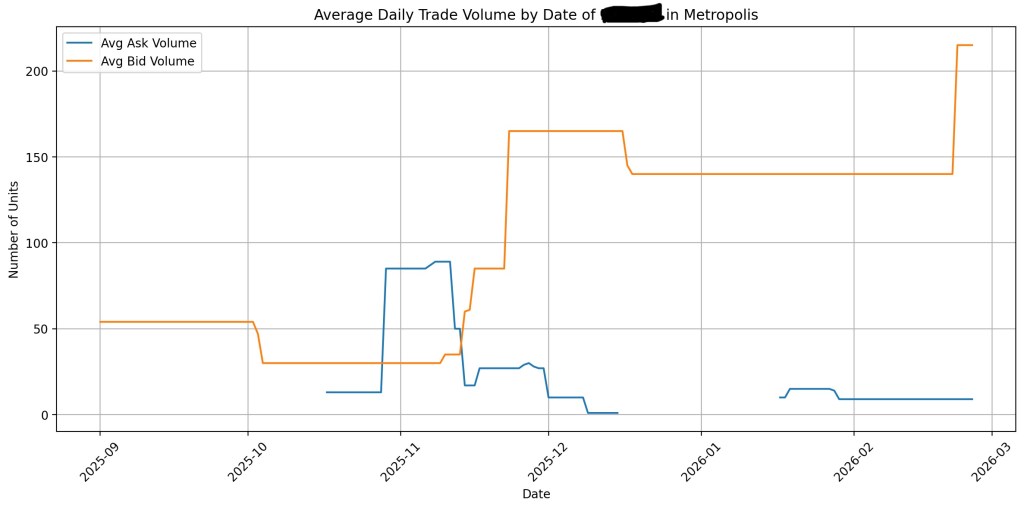

Looking into a carrier-class ship, we are seeing greater bid/buy demand outstripping sell/ask volumes in Hek. Additionally, as we look into the current meta for carrier-based fighters, a similar pattern, lined up to the time around the dissolution of PanFam, but also the Carrier buff around the same time, there seems to be evidence of someone in Hek potentially trying to support internal manufacturing with external buys to be on the ready.

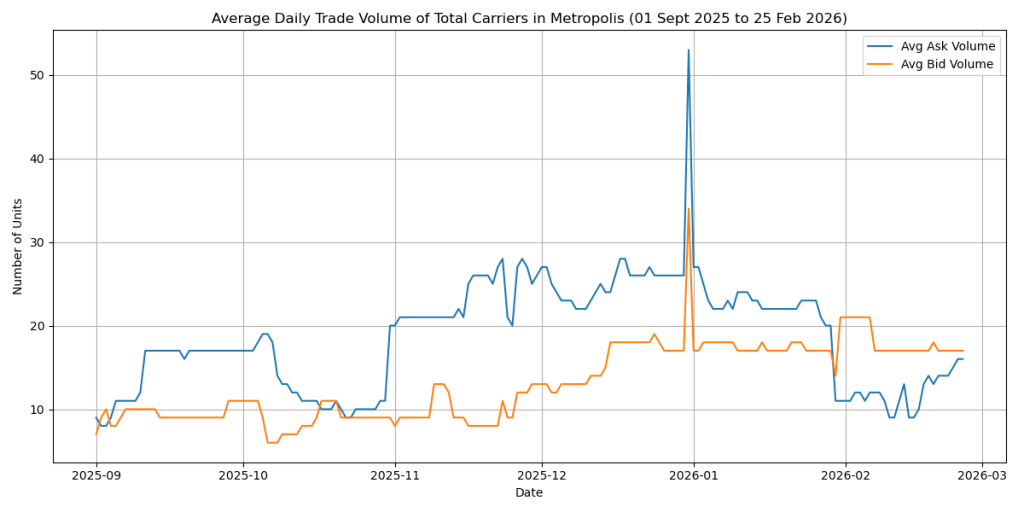

However, broadening the scope to all carriers, this inversion goes away and doesn’t manifest until the end of January of this year. In addition, the big spike in both curves around the end of 2025 suggests that someone was both buying and selling in great quantity. However, given that the spike is on one date and then returns to normal suggests a few things, 1) mistaken orders that were subsequently taken off the market the next day, 2) a data processing issue (the rest of the data looks good and within normal parameters), or 3) vaild short order with the intention to manipulate the market, that was was ultimately resolved the next day.

For null-bloc politics, bringing carrier hulls into hi sec trading hubs is not profitable nor possible (carriers can’t fly in hi sec) given the high-risk nature of bringing high-value cargo into low and high sec space.

If this in fact, a market driven by null sec politics, then null sec is going to start speeding up carrier construction in null sec, considering that there seems to be interest in what is fast becoming the dominant meta. There is potential that this is low sec alliances related, and that given null is quiet at the moment.

The question, of course, on my mind is why Hek? Wouldn’t it be easier to base everything from Jita? It might lie with the fact that Jita and the surrounding area are ripe for ganking squads. Hek is more out of the way in Metropolis and not as directed to as the central location for trade by CCP. Hek is also relatively close to both the Imperium and Winter Coalition null-sec territories. Which side or sides are using Hek as the base of carrier logistic prepping and without any character information attached to order books, we cannot really know. It is clear that someone with a vested interest in the dissolution of PamFam is either rebuilding through hi sec, or prepping for a future escalation.

Hek does have the new advantage of having EVEGuru’s, led by Fern Kitsuen, new industrial park in Anher. There is a good chance that Hek will further develop into the second-largest trade hub. However, given that there are rumors that CCP has plans for developing a more robust trading market, instead of having Jita be the central market, EVEGuru seems to have lucked out.

In other ways, Minmatar space is popular for Faction Warfare content, so it comes with the need for more ships. Carriers can’t roam high sec, Hek would be the primary place to at least stock up on items for FW, so they could be transported. An additional caveat is that my data is looking at region and not system, so while Hek is in Metropolis, and that is useful as a signal, we also run into that limitation, and the carriers being purchased are being traded in low sec.

The main takeaway of this brief basically comes down to if push came to shove and war breaks out, there is likely someone already prepping. If you are a null sec bloc or have vested interests out that way, it is time to start thinking about starting your preparations sooner rather than later. If you are an industrialist, it’s time to start thinking about spreading out and considering other markets that are growing.

I might be back writing (doing a bit of real-life literary writing too), so if you want to catch my market briefs, be sure to subscribe to the blog, when a post goes live. Don’t plan on having a regular day to post, so subscribing is the only way you will see everything

No ads, no AI (anymore), no BS.

Sources

Python

Jypter Notebooks

Adam4Eve.eu API

EVERef

Personal anonymous sources