CCP dropped the Monthly Economic Report (MER) for June in the morning (USTZ ET) of July 10th.

There are some nice market nuggets inside the report and at least two I’ll highlight here.

The Data

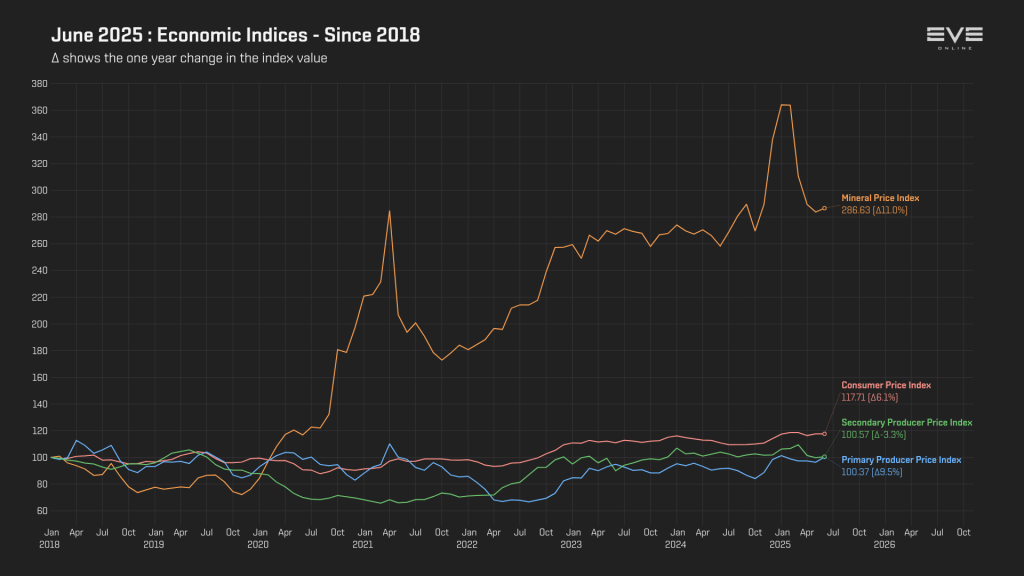

- Mineral Price Index rose 9.5% suggesting that 1) the pyerite buffs had limited effect on the monthly index since they were late in the month, 2) according to analysis by Oz, pyerite bounced and went back up to pre-patch levels, 3) if pyerite is not the influencing mineral, there’s another shortage somewhere in the markets that’s causing a small rebound.

- Primary production (so reactions, mining reprocessing, and assorted production) is up 9.5% while secondary production (modules, hulls, components, etc) were down 3.3% suggesting somewhere there’s a production blockage.

- Mining value is also down significantly, correcting from the big boom in May.

Analysis

Overall, the markets are starting to correct from the highs of May. This suggests that war preparations were well under underway in May, and if people were watching the markets close enough, industrialists might have been able to keep themselves from losing money on the markets as demand would eventually end, and production lagging behind demand. This puts my post on the Ferox Navy Issue hull within a broader context, because the producers that were early on the markets were the most successful at getting the best ask price.

While the battles between the PandemicHorde and Imperium were large, the sheer lack of battles turned them ultimately into skirmishes, thus reducing destruction and reducing demand.

In addition, the lack of pyerite in the market has also hamstrung production efforts with industrialists, probably lightening their load of production to strictly items without large quantities of pyerite needed or only producing only needed items that need pyerite. This is also emblematic of a situation where the fleet stock was already high and that those that saw the pyrite crunch coming, were likely over producing in advance.

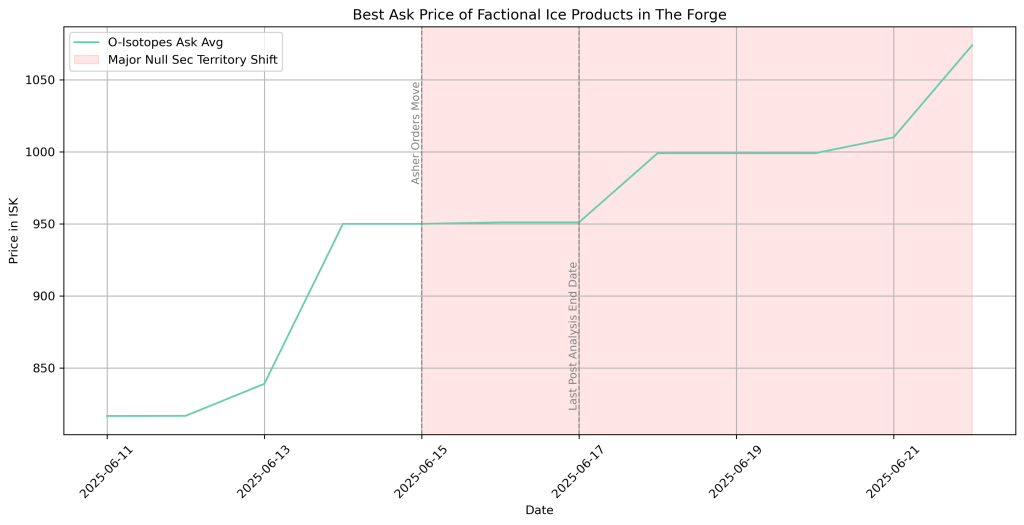

The lack of minerals is also likely due to lower mining values because of lack of full scale mining ventures out in the belts. This likely due to the most recent null sec reorganization and movement, which suggests other minerals are going to get squeezed similar to pyerite.

I’m already seeing some evidence in the mexallon markets of an inflation of demand so until null sec movement settles down, I suspect the mineral market and the EVE Mineral Price Index will continue to rise.

Takeaways

- Miners: If you aren’t already mining for pyerite, and to a lesser extent mexallon, get out to the fields. Feel free sell directly to bids because this point that is where the biggest demand is. If you aren’t part of the sov null and generally stay in high or low sec, you should be able to capitalize.

- Industrialists/Producers: Formalize contracts with miners (or freelance jobs) to get minerals to you. The market is still trying to find where it will land, especially after the patch, and the market doesn’t seem to be willing to let pyerite to relax. Since that is the case, I would recommend staying off the markets and continue to work through contract.

- Traders: If y’all are reason that pyerite is not settling, let it go before you crash the entire economy (at least on the market boards). Pyerite is crucial to the game and why CCP is willing to inflate the availability. The minute it gets expensive to fly ships, the minute everything around the game stalls content-wise. Not everyone has billions and trillions of ISK in reserve and the real world economy is starting to slow, that creates a very risky situation for CCP and EVE, who rely on PLEX purchases and subs, and the minute it becomes more expensive to play, more players will drop out of the game.

Like my analyses and want to keep up with my posts? Consider subscribing and get the post sent directly to your inbox!

Sources

EVE Markets – Mexallon

Discord